Driving student engagement with financial news

Having taught Portfolio Investment to Masters students for two years, I was searching for a better way to drive regular student engagement. I was using polling software in class to assess learning and encourage real-time feedback, but was there a better way to help students develop the mindset of professional asset managers, and to encourage students to read, understand, and practically apply the news in the financial press?

I had previously encouraged students to read the Financial Times using the University’s institutional subscription, but became convinced that this ought to be accompanied by a structured exercise in reading, analyzing and acting on financial news. Deep Learning demands that learners be able to apply their knowledge to new situations and act creatively upon it; and employers seek candidates who come with an active body of awareness of recent events in the financial markets, and who can act on their interpretation of the financial news.

I had previously encouraged students to read the Financial Times using the University’s institutional subscription, but became convinced that this ought to be accompanied by a structured exercise in reading, analyzing and acting on financial news. Deep Learning demands that learners be able to apply their knowledge to new situations and act creatively upon it; and employers seek candidates who come with an active body of awareness of recent events in the financial markets, and who can act on their interpretation of the financial news.

Estimize, Inc. is a crowdsourced financial forecast platform, where contributors can earn cash prizes for consistently making accurate forecasts. Estimize forecasts have been shown to be more accurate than those of the Wall Street consensus.

Estimize had introduced Forcerank, in which contributors rank a set of 10 assets in order of their expected performance over the coming week, before the start of trading every Monday. Participants are then awarded points for their accuracy after market close on Friday, once the actual performance is known. Participants who gain a large number of points are able to earn cash prizes. Forcerank is accessed through an iDevice app.

I saw the potential for using the ForceRank system to drive student engagement with the financial news, and asked Estimize to create a bespoke ForceRank competition for my students, to predict the relative performance of ten European stock market indices.

Students did not have to predict the actual level the stock markets would reach, only which would perform better and which would perform worse.

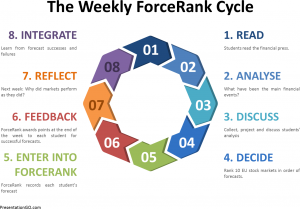

Each week, the process involves:

- Students read the financial news during the week, making use of the department’s institutional subscription to the Financial Times.

- At the start of the Monday lecture, students discuss in pairs the financial news of the previous week, writing down what they consider to be the most important for the ten European countries we are considering, together with an explanation of why they think they are significant, and what their effect would be.

- Next, these are collected in and projected for all the class to see, so that the key events can be identified. We have a class discussion on the ideas presented, talking about the students’ predictions for which countries’ stock markets will outperform, and which will underperform, over the coming week.

- Students make their own predictions, and use the ForceRank app on their own iDevices to upload them to the system.

- On the Friday of each week, the ForceRank system works out the actual performance of each stock market, and awards each student points for their accuracy.

- We then discuss the previous week’s actual performance, and potential reasons for it, at the start of the next week’s class.

Each student accumulates points over the progress of the term, so that the top ten students over the term can be identified for prizes and certificates.

Sadly, Estimize discontinued the ForceRank system at the end of the academic year. They do still offer the ability to contribute macroeconomic or earnings forecasts, but these lack the immediacy of having a weekly read-analyze-estimate-feedback cycle.

It is also much more difficult to make accurate point estimates of future earnings than it is to make relative rankings of performance, so that Estimize’s core business of crowdsourcing point estimates of future corporate earnings is much more difficult to engage students in.

Future opportunities

When I presented this project at Teaching & Learning conferences, I was struck by the number of teachers from other universities who wished that they could use a similar system in their own teaching. It became apparent to me that if the University of Manchester could build and maintain a replacement for ForceRank, that it would have a wide and active takeup, both domestically and internationally.

The Business School has a truly excellent eLearning team, and the capability to develop such an app, and it would be an ambition of mine to work with them to develop and market this sort of app, and train other institutions in the teaching methods which it helps to support.

Evaluation / Student Feedback

After taking his course, I care about the updated financial news more often and get used to read FT every week. Though professor Godfrey’s encourage, I also have much more progresses in information finding.

Forcerank is amazing. I wish other modules included a way to raise students commercial awareness. This has really helped me in preparing for interviews. It really brought a practical touch to the module. It was just really really amazing and I always looked forward to this part of the lecture.

Forcerank: excellent idea as well. It forces students to read the news and be aware of the macroeconomical and geopolitical changes. According to me, developing students’ awareness of the world changes is also part of the University’s task. Theories are not enough to make us become good decision-makers in this fast-changing world.

Benefits

I was able to identify an off-the-shelf app which was immediately available, and which was supported by a well-resourced commercial team who were prepared to partner with me, and negotiations with them were fruitful and rapid.

The quality of the interface, and its immediate availability, made rollout painless. Further, Estimize were very helpful in facilitating the prize-awarding aspect of the project, by providing student rankings.

Top Tips

- Besides the offer of prizes at the end, I found that participation in exercises of this type works better when linked to assessment. The obvious mechanism is to award students marks for consistent participation, regardless of their final ranking in the competition.

- However, changes to the assessment system need to be approved by Faculty and School many months in advance: a full integration would have required a formal submission to University authorities, to alter the means of assessment to include a ForceRank participation element.

- Without this direct link to assessment, I found that some students questioned the benefit of spending time on the ForceRank exercise, and also, that student participation in the exercise declined over the term.

- The process could perhaps be made more efficient by using TurningPoint or other similar software to enable students’ contributions to the classroom discussion to be directly projected to the screen.

- Additional student engagement can be encouraged by setting up a blog for the exercise, where students can debate their predictions.

School: Alliance Manchester Business School (AMBS)

Discipline: Finance

Academic: Chris Godfrey

Course: BMAN71171 Portfolio Investment

Cohort Size: 160 students

Themes: Enhancing learning with technology, Active Learning, Teaching Idea(s)

Ref: 061

0 Comments