Defending the Haitian Debt

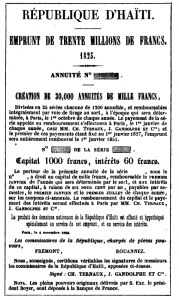

France’s recognition of Haiti’s independence in 1825 – an independence that the former colony, Saint-Domingue, had enjoyed de facto since its military victories more than twenty years earlier – came with a set of onerous financial conditions. A 150-million-franc indemnity to former planters combined with a loan of 30 million francs (contracted to cover the first of five annual payments) to birth the infamous “double debt,” payments owed to French creditors that constrained Haiti’s public expenditures for much of the nineteenth century. In French terms, the monies received from Haiti were relatively small, representing between 2% and 1% of its annual GDP over the century. But for Haiti the costs of servicing the debt were significant, swallowing at times as much as half of public expenditure.

The loan was vaunted in France as an economic and political windfall. Reserved for the French market by the negotiations that affirmed Haiti’s independence, it was a gift to the country’s financial sector, which had been somewhat peripheral to the mania for foreign loans that dominated the English market in the early 1820s. And it was another arrow in the quiver of measures that the Comte de Villèle, head of France’s government during much of the 1820s, used to support his chief economic policy: the conversion of state debt to fund a massive indemnity to émigré landowners, ending their claim to properties confiscated during the Revolution.

From Lepelletier de Saint-Remy, Saint-Domingue: Étude et solution nouvelle de la question haītienne (1846)

In some ways, to investors the Haitian loan was another in a slew of foreign loan ventures. French journalists compared it favourably to Mexico or Columbia’s and weighed up its chances of success against the Spanish loan issued at the same time. But its political significance was never far from view. Oppositional newspaper Le Courrier wrote in October 1825 that “In a few days, Paris, who didn’t want anything to do with lending to the King of Spain, will give millions to Boyer [President of Haiti]. Who would have said it forty years ago? Things that were unthinkable in 1785 are completely straightforward today, much to the horror of a few people who don’t want to advance with their century, who despair with each forward step.” In the first volume of the Saint-Simonian journal Le Producteur, the loan was “without question the most characteristic fact of our current moment,” illuminating the future as it “achieves the reconciliation of the white and Black races.” The brochure advertising the loan was penned by Louis-Guillaume Ternaux and addressed to the Duc de La Rochefoucault-Liancourt, both important figures in the Société de la Morale Chrétienne, a major source of anti-slavery activism in the early nineteenth century.

What, then, did it mean to become a creditor to Haiti following its independence – to purchase, hold, and defend, frequently over long periods of time, the rights to extract payments from the former-colony-turned-sovereign state? Humanitarian impulses may indeed have motivated some early purchases – though the vision of racial reconciliation trumpeted by Le Producteur above is somewhat complicated by the fact that the loan’s chief banker, Jacques Laffitte, subsidized the paper. Certainly, bondholders would later contrast their own rights favourably against the illegitimate and exploitative claims of former slaveholders (the indemnity holders), and a liberal discourse praising the civilizational uplift that came to a country properly honouring its debts and international agreements was prominent when rentiers made their cases for repayment.

But there is little evidence of such feeling being widespread, or long-lasting. Like other loans of this sort, bonds were initially expensive (the investing public was an elite group) with a face value of 1000 francs apiece, and a promise of 6% return (the same as earlier loans by Colombia and Peru, higher than Brazil, Austria, Portugal, or Spain). The banking syndicate that brokered the loan got the contract for only 800 francs on the bond – meaning Haiti received only 24 million for its 30-million-franc debt, and paid 7.5% in interest (a high rate). These terms suggest some difficulty in finding a public for the bond – the terms had to be sweetened to be tempting for both the underwriters and the retail investors. The bond debuted at the Bourse slightly higher, at 840. Within a year, however, its price had begun a long decline: from 670 francs in 1826 to 345 in 1829, bottoming out at 200 francs in 1832. Bankers may have initially believed Haiti’s capacity to pay, but they remained holders of large numbers of bonds that they could not issue as the market slumped and buyers dwindled. (At least one banker, Pierre-François Paravey, was pushed to suicide by his bank’s failure after the affair. But all was not so dark for the underwriters. In a transaction that generated a minor scandal, in 1833 Jacques Laffitte had a thousand of his own Haitian bonds reimbursed by the Haitian government at their full face value, receiving one million francs when he had spent only 800 000, and the bonds themselves would have cost 270 francs on the market.)

Yet some investors did materialize; historian Jean-François Brière estimates that there were between two and three thousand initial buyers of the loan. Early profits were meagre. Haiti made no payments after the first in 1826, and if bondholders received interest payments in 1827 and 1828, it was thanks to subsidies to the issuing banking houses authorized by the French government. The Haitian government expressed its willingness to pay – often observing, like bondholders, that the loan was a debt of honour whose satisfaction was of a different order to the “political” debt of the indemnity. But public resources were slim, and political events – such as the 1830 Revolution in France – were seized upon as occasion to renegotiate the extortionate amounts outstanding.

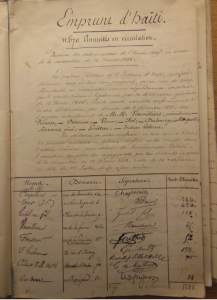

A list of members of a group representing 520 bondholders of the 1825 Haitian Loan, composed in 1851. Source: Ministère des Affaires Etrangères, La Courneuve, France.

In these circumstances, the private investment decisions of bondholders become visible to the historian as they emerge in lobbying groups using political and public forums to pursue recovery of their loans. As early as 1830, the first bondholder association was formed, presenting its demands to Haiti’s foreign envoys and the head of the French Council of Ministers. As part of such groups and on their own, bondholders wrote letters to government officials, presented petitions to the Chamber of Deputies, and maneuvered to include their representatives in successive renegotiations of Franco-Haitian commercial relations.

A list of bondholders who signed up to a renewed association in 1851 gives us a sense of the social world that this investment helped construct. The driving force channeling bondholder activism in the 1840s and 50s was a group of significant investors aligned around one Jean-Pierre Vaur. Vaur was a merchant from Carcassonne who set up in Port-au-Prince in the 1820s, attaching himself to the French missions renegotiating Haiti’s debts in the 1830s. (The Haitian historian Thomas Madiou describes Vaur in this period as having no official function, which did not stop him from acting as self-important as if he had.) By mid-century he owned over 400 bonds, likely acquiring them when prices were low. He and his associates represented bondholders in establishing new payment terms in 1848, after which a group of bondholders split away, discontented with new reductions in their payments that had been agreed. Vaur’s group requested those who were happy to remain to sign a membership list, either in person or via a representative; the Haitian envoy, Séguy-Villevaleix, affixed his delegation’s seal to confirm the authenticity of the document.

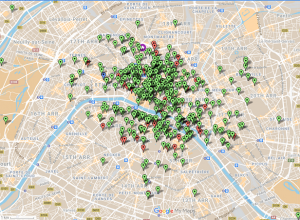

The list is composed of names and addresses of 520 bondholders (or their representatives), along with the number of bonds that each owned. It has some puzzling, or at least distinctive, characteristics. The vast majority of signatories are from Paris – which can be explained in part by the city’s significance as a financial capital, and also reflects provincial investors’ (necessary) recourse to representatives near the financial centre. But as it is not always clear when a signature is inscribed on behalf of another person, the overwhelming picture is of bonds which barely left the capital city. Some signatures appear more than once (Vaur signs three times, each for different numbers of bonds; possibly as a representative for other creditors?). Some addresses also repeat, attached to different names; neighbours, potentially, or simply errors – street and name spellings are sometimes approximate.

Map of signatories to the 1851 Haitian loan bondholder association. Source: Ministry of Foreign Affairs, La Courneuve, France.

Slightly over sixty of the adherents who signed were women – about 12% of the total – and they spoke for just over 800 of the 8 583 bonds represented in the group. In terms of concentration, only sixteen people (including one woman) held more than 100 bonds, while nearly half owned fewer than five. Sixty-four signers claimed only one bond, making their engagement with the group notable; even a small financial outlay could form the basis for mobilization around the issue of repayment (though of course we cannot know what this outlay represented to any particular investor). To finish a brief sketch, about 15% of signatories can be found in the commercial directory, the Annuaire Didot-Bottin, from which we can learn their professions or occupations: Balsemini, owner of ten bonds, made and sold spirits on the rue de la Bucherie; Louis Barbier (seven bonds), worked as a conservator at the Bibliothèque du Louvre; Baron (four bonds) sold hardware on the rue Saint-Dominique; Madame Bernard (one bond) was likely married to a retired tax administrator; Dubasque (sixteen bonds) was a boot manufacturer, and Fennetaux (eight bonds) a hairdresser.

Such a list provides tantalizing grounds for speculation about the individuals who not only owned Haitian debt at mid-century but were sufficiently “invested” to secure their representation in a national group dedicated to creditor interests – individuals who lent their voices (and membership contributions) to a politically connected group of large investors committed to extracting whatever they could from the Haitian government. Their agitation kept the issue of Haitian credibility and the perceived sacrifice of French financial interests before the eyes of the French government and reading public for decades, until the final repayment of the original loan in the 1880s. As future blog posts will explore, bondholder groups of this nature were a key element of French globalization in the nineteenth century, and Haiti’s loan – one of the earliest foreign loans on the French market – formed an important school in which ordinary investors practicing neo-colonial extraction learned the tools (and dispositions) of bondholder organization.

Further reading:

- Frédérique Beauvois, “Monnayer l’incalculable ? L’indemnité de Saint-Domingue, entre approximations et bricolage,” Revue historique 3, no.655 (2010): 609-636.

- Jean-François Brière, Haïti et la France, 1804-1848. Le rêve brisé (Paris: Karthala, 2008)

- Mary Dewhurst Lewis, “Legacies of French Slave-Ownership or the Long Decolonization of Saint-Domingue,” History Workshop Journal 83 (2017): 151-175

- Thomas Madiou, Histoire d’Haïti: T.7, 1827-1843 (Port-au-Prince: Editions Henri Deschamps, 1988 [1847])

- David Todd, A Velvet Empire: French Informal Imperialism in the Nineteenth Century (Princeton: Princeton University Press, 2020)

- Marlene Daut’s overview, “When France Extorted Haiti,” in The Conversation, June 2020