The World (of documents) Investors Made

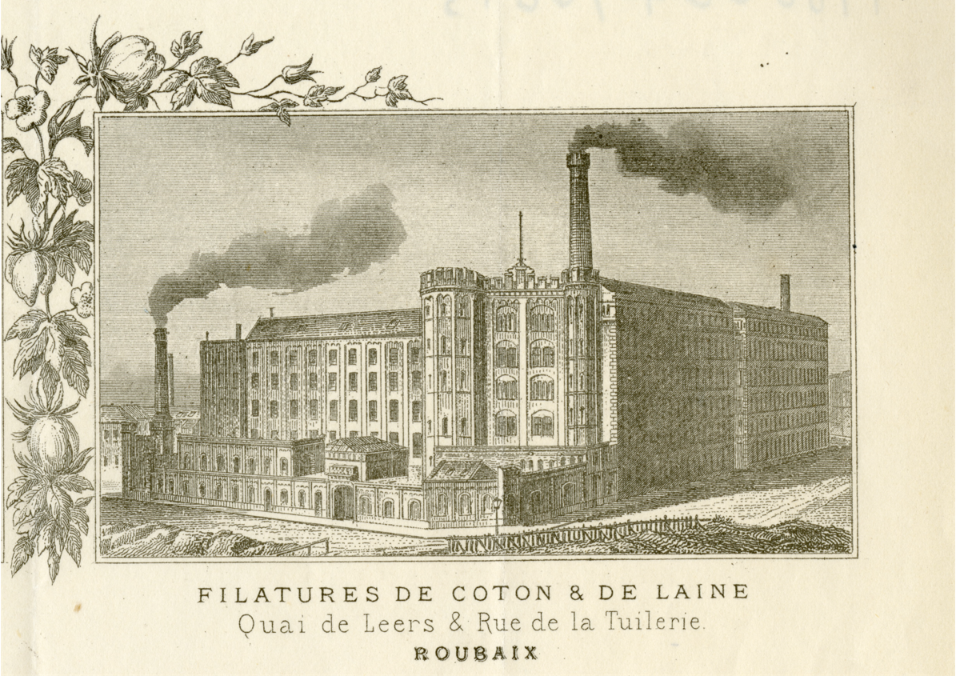

A historian of French economic life will very likely find themselves visiting the Archives Nationales du Monde du Travail – the National Archives of the World of Work – at some point in their project. Located in the former industrial city of Roubaix, near Lille, the archives are housed in a converted cotton mill, once a substantial establishment but now rather adrift, surrounded by an outlet shopping complex that replaced the city’s first modern commercial centre, Roubaix 2000 (built in the 1970s, complete with the largest parking lot in the north) in the late 1990s. Visitors emerge into the nondescript shopping area after being deposited by Lille’s driverless metro, which continues on to the nearby border with Belgium. Old economic powerhouses or new, the mill and mall both are unglamorous architectural pastiches. That the building’s refurbishment adopted a vaguely nautical motif adds to a disorienting feeling of being lost at sea.

The archive is the resting place of documentation from groups and individuals that in life would not have envisioned their shared fate: banks and trade unions, charities and nationalized enterprises, professional associations and social movements…the wide-ranging business and labour that make up the polyvalent ‘world of work.’ Conceived in the midst of France’s deindustrialization, the Roubaix site is the only one of five projected centres dedicated to the country’s industrial heritage that was realized. It is also the only one of the country’s national archives whose collections are drawn from civil society and the private sector. All of this – its mission, its location, its origins – make it an (invaluable) aberration in the country’s national heritage regime.

The first annual report of the ANPFVM (1899-1900). Source: ANMT 2004 039 2465

A large but largely unlauded collection stems from the Association National des Porteurs Français de Valeurs Mobilières (ANPFVM) – the National Association of French Securities’ Holders, which began its life in 1898 as the National Association of French Holders of Foreign Securities. (In both instances, a more economic and felicitous translation would perhaps be National Association of French (Foreign) Investors.) The association was founded at the behest of the Ministry of Finances but was officially an arms-length organization, organized under the patronage of the Company of Stockbrokers. Its purpose was to help securities’ owners defend their interests in the event of problems with their returns – a state that declares bankruptcy, or a company that suspends payments of changes the currency of reimbursement. Bondholders were the association’s especial remit; they enjoyed less authority in the direction of an enterprise than shareholders, and foreign bondholders in particular faced obstacles in defending their interests across jurisdictions.

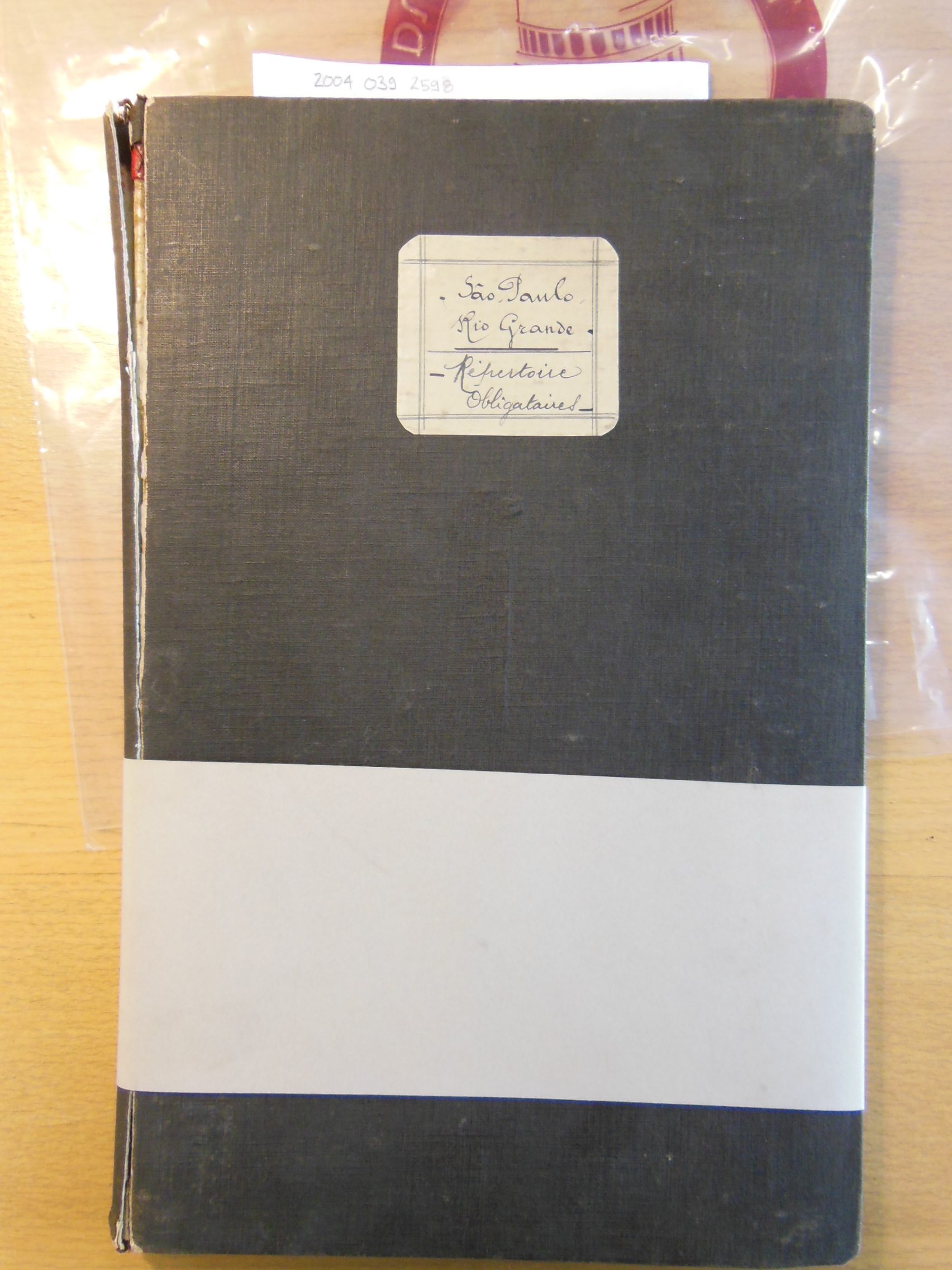

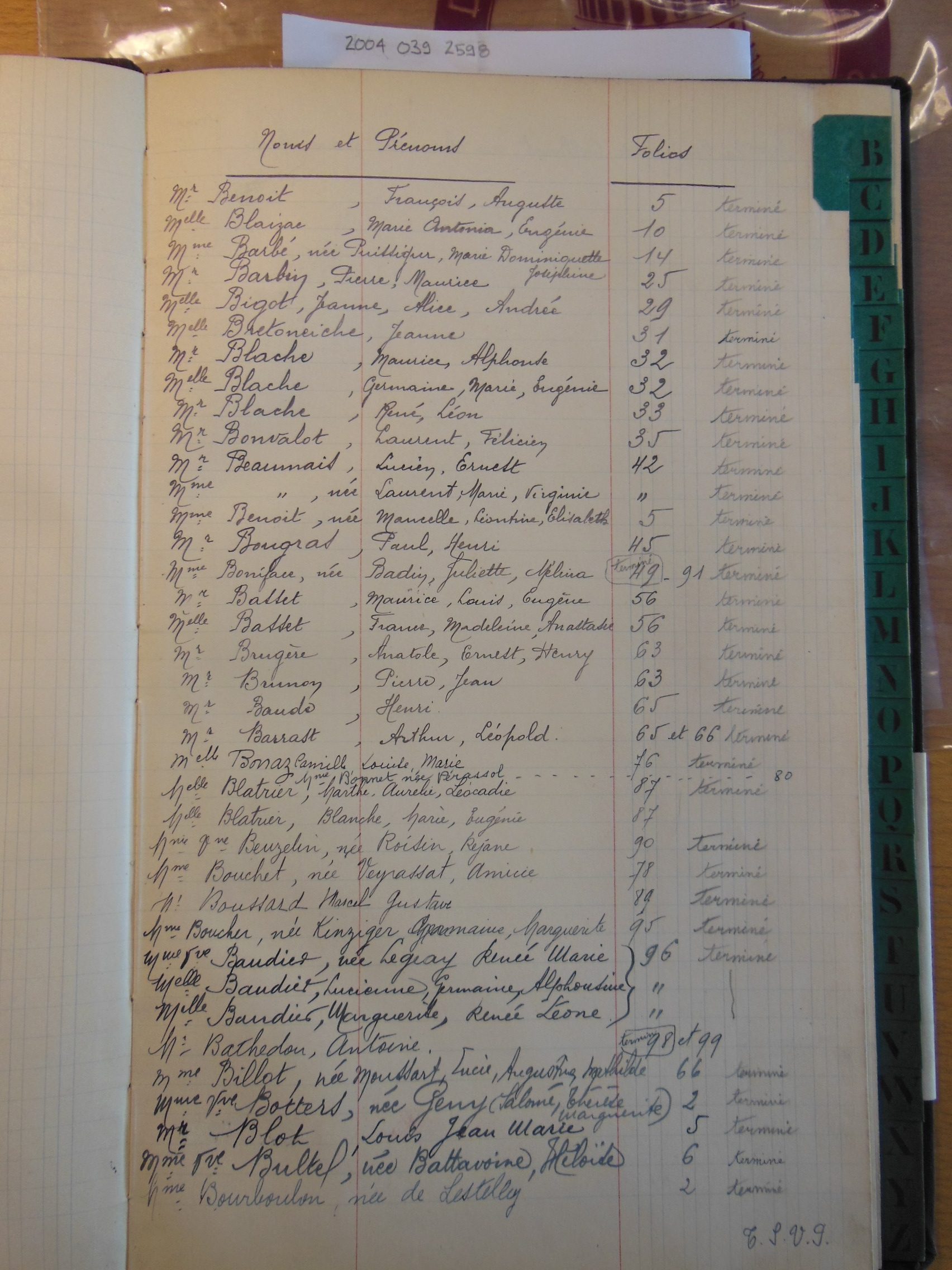

The ANPFVM would help coordinate investors into defense groupings like the bondholders in the Sao Paulo-Rio Grande railway, recorded in the register below. Once assembled as representatives of the majority of bondholders, these groups could enter into negotiations with bond issuers. Backed by the tacit, and sometimes material, support of the French government and the French Exchange, the goal was to achieve a collective outcome that would preserve their investment as far as possible.

The national association’s organizing council was composed of bankers, legal authorities, former finance and justice ministry officials, and members of the governing bodies of the Company of Stockbrokers. Its most active (and activist) members were Eugène Lacombe, a senator, and Tony Chauvin, a bank clerk who parlayed his experience as a junior clerk at the Union Générale bank when it crashed in 1882 into a decades-long career in professional investor advocacy. The British Corporation of Foreign Bondholders (founded 1868) was an explicit forerunner, though the French association rejected its corporate model in favour of organizing early as an institution of ‘public utility.’ (In fact, the British body reorganized as a public-interest institution in the same year.)

From the vantage of its present-day archives, the association’s operations (and ambitions) as an information hub are of particular interest. Its archival function was announced in the second article of its statutes. In order to defend “the capital of national savings invested abroad,” the group would “establish archives gathering and organizing all documents and information concerning foreign securities issued or traded in France,” maintaining a network of foreign informants and publishing relevant reports and bulletins. In one of its first annual reports the association boasted of its role as an information node at length:

“Last year we reported on the key importance of our archives, where all the documents that we discover relevant to thousands of affairs are gathered and classified – statutes, notices, circulars, brochures, press writeups, etc. Since then we have completed a large number of these files, enriched most of them, and created 1500 new ones.

The number of newspapers, magazines, etc. that we receive, from France and abroad, has nearly doubled, reaching nearly 900 per month. […]

Each of these is read, annotated, then cut out and distributed into the files, overlooking not a single affair relevant to French investors. […] We have the firm hope that one day we will possess the most complete archive on securities it is possible to have.”

The association claimed an extensive communication network, encompassing bondholder organizations across Europe, French government ministries, regular correspondence with three hundred French and foreign bankers, as well as 20 000 occasional correspondents, often members of various committees, who forwarded materials for the association’s benefit. It was this mastery of information that provided one of the greatest arms of the association, which, after all, had no authority other than that it acquired from friendly connections and little leverage beyond the power to publicize the situation of bondholders in relation to particular companies.

Founding membership certificate, Tony Chauvin. Source: 2004 039 2467

There has been little research on the work of this association; certainly nothing matching the level dedicated to its British counterpart. As a result, we are not yet well informed on the scale of its action or the scope of its activity. It was certainly heavily involved in numerous negotiations with foreign states in the period leading up to the Great War – a peak period of French capital exports – and played a particularly important role in representing French property interests in Europe in the war’s aftermath, as investments in empires were parceled into the debts of new nation-states. The association adopted a congenial stance towards France’s financial establishment. It invited members of large banks and investment houses onto its committees, encouraging them to see the association as “useful and disinterested support during critical moments” rather than a hindrance to their affairs. Its influence with bondholders would be “moderating and pacifying.” Cultivating, educating, and rewarding France’s investor class put the association and the country’s financial interests in alignment. The ANPFVM continues this mission in its current iteration, as the Institut pour l’éducation financière du public, or Finance pour Tous (Finance for all), a body that maintains close links to the NYSE Euronext and French government and that works within a framework of financial betterment, using a discourse of literacy and inclusion to expand the reach of finance.

The association is clearly a group that falls within the ANMT’s remit, and the archives in Roubaix house the bulk of what remains of its organizational and advocacy material. Handsome volumes certify the status of founding members, and metres of annual reports, personnel and accounting documents, and dossiers on individual defense associations allow a reconstruction of the character and work of the association. Fifteen hundred volumes of the group’s library, too, are among its collections, giving researchers access to the informational world that was so important to the group’s mission of making the world safe for French finance.

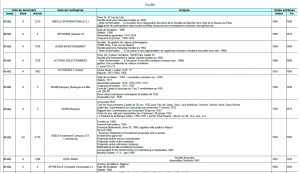

But the classification of one part of the collection is particularly noteworthy, and somewhat difficult to detect. The individual dossiers that the association assembled on a slew of French businesses – from real estate to banking to coal mining and electricity – today form the basis of the ANMT’s extensive 65 AQ series, whose files offer statutes, press clippings, advertisements, annual reports, and other miscellaneous material on thousands of the country’s enterprises.

The 65 AQ inventory is nearly 2700 pages.

It is fitting that the labour of making and defending a national investor class has been recognized with a home in the ‘world of work’. That financial markets involve labour, professional jockeying, and government lobbying – all richly documented in the association’s archive – can be overlooked in accounts of market development. But it’s also critical to recognize that this work involved assembling a world that aligned with and served the investor’s interests. The original dossiers – compiled from the 1890s through to the 1960s – were substantially expanded by later archivists, meaning that the core of the commercial landscape as it was viewed by France’s investment champions now forms only a small section of the voluminous documentation on French enterprise. But the seeds of the investor’s gaze remain, its priorities patterning subsequent collections. To a certain extent, what we can know about these businesses remains what was important to shaping investors’ judgement and enforcing their claims.

Collections on the ANPFVM

- Ministère des Affaires Etrangères :

Affaires Commerciales 1ADC/598 - Archives Nationales du Monde du Travail :

2004 039; 206 AQ; 65 AQ; 2003 040 1112 - Centre des Archives Economiques et Financières :

There are dossiers here on the founding of the association (e.g. B-0068736 ; B-0068737 ; B-0061807 ; B-0065770/2) , while others are scattered between various affairs: the Chinese loan of 1905 (B-0065140; B-0065026); African mining companies (B-0031212); Spanish railroads (B-0031193/1, B-0031195…); Serbian debt (B-0065244/1), etc., etc.…